Intriguing Insights into the Functioning of Treasury Bills

An Overview of Treasury Bills and their Significance

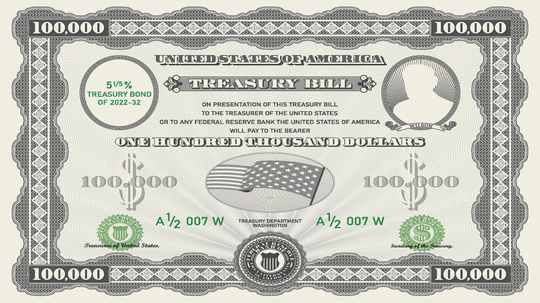

Treasury bills, commonly referred to as T-bills, are short-term debt instruments issued by governments to finance their operations. These financial tools play a crucial role in managing a country’s cash flow and ensuring stability in its economy. By comprehending the mechanics behind treasury bills, individuals can gain valuable insights into how these instruments function within the realm of public finance.

The Process: Issuance and Auctions

When it comes to issuing treasury bills, governments typically conduct auctions where investors bid for these securities. The auction process involves potential buyers submitting competitive bids stating both the quantity they desire and the interest rate they are willing to accept. The government then reviews all submitted bids and accepts those with the lowest interest rates until it has raised enough funds through this issuance method.

Investor Benefits and Risks Associated with T-Bills

Treasury bills offer several advantages for investors seeking low-risk investment options. Firstly, they provide a secure avenue for preserving capital as they are backed by the full faith and credit of the government that issues them. Additionally, T-bills offer liquidity since they can be easily bought or sold on secondary markets before maturity dates without significant price fluctuations.

A Stepping Stone towards Financial Literacy

Understanding how treasury bills work is an essential step towards building financial literacy skills. By grasping concepts such as auctions, investor benefits, risks associated with these instruments, individuals can make informed decisions about investing in T-bills or other similar financial products available in today’s market.

In conclusion,

taking time to comprehend the mechanics of treasury bills can empower individuals to navigate the world of public finance more effectively. By recognizing their significance, understanding the issuance process, and evaluating investor benefits and risks, one can make informed decisions when it comes to investing in these short-term debt instruments.